indiana estate tax return

Your W-2s 1099s and a copy of last years state and federal tax returns. According to IC 6-3-4-1 and for taxable years beginning after Dec.

Information Line Call the information line at 317 232-2240 to get the status of your refund billing and payment plan.

. Check your Indiana Tax Refund Status. Indiana Fiduciary Income Tax Return. Entitys Composite Adjusted Gross.

Indiana Income Taxes and IN State Tax Forms Step 1. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source.

No inheritance tax returns Form IH-6 for. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

For more information please join us for an upcoming FREE seminar. The estate would pay 50000 5 in estate taxes. 31 2012 every resident estate or trust having gross income or.

Know when I will receive my tax refund. Estate or a trust is sometimes referred to as a pass-through entity. You can apply online by fax or via mail with the IRS to.

Many of the necessary. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Eric Holcomb said an estimated 43 million taxpayers will receive a 125 refund after filing their 2021 state taxes.

Inheritance Tax Refunds In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if. You would pay 95000 10 in inheritance taxes. If you have additional questions or concerns about.

Find Indiana tax forms. 31 rows Generally the estate tax return is due nine months after the date of death. An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than.

IT-41 Schedule IN K-1. Just one return is filed even if several inheritors owe. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note.

Calling 1-800-TAX-FORM 800 829-3676. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one. Please read carefully the general instructions before preparing.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. A federal estate tax return will be required only if the deceased persons taxable estate is very largefor. Most estates and trusts file Form 1041 at the federal level and file Form IT-41 at the Indiana level.

Contact an Indianapolis Estate Planning Attorney. The state is returning 545 million to Hoosiers after. Filing a typical tax return is simple but completing one in the name of a decedents estate requires a little more work.

In general estates or beneficiaries of deceased. Up to 25 cash back Income tax returns may also be required for the estate itself. The executor administrator or the surviving spouse must file an Indiana income tax return for the individual if.

You would receive 950000. The deceased was under the age of 65 and had adjusted gross income more than. Updated April 04 2022.

A six month extension is available if requested prior to the due date and the estimated correct amount of. Inheritance tax was repealed for individuals dying after Dec. The state income tax rate is 323.

Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits long. Up to 25 cash back That process outlined in Indiana Senate Bill 923 will take ten years completely eliminating the tax in 2022.

Indiana Estate Tax Everything You Need To Know Smartasset

2021 Estate Income Tax Calculator Rates

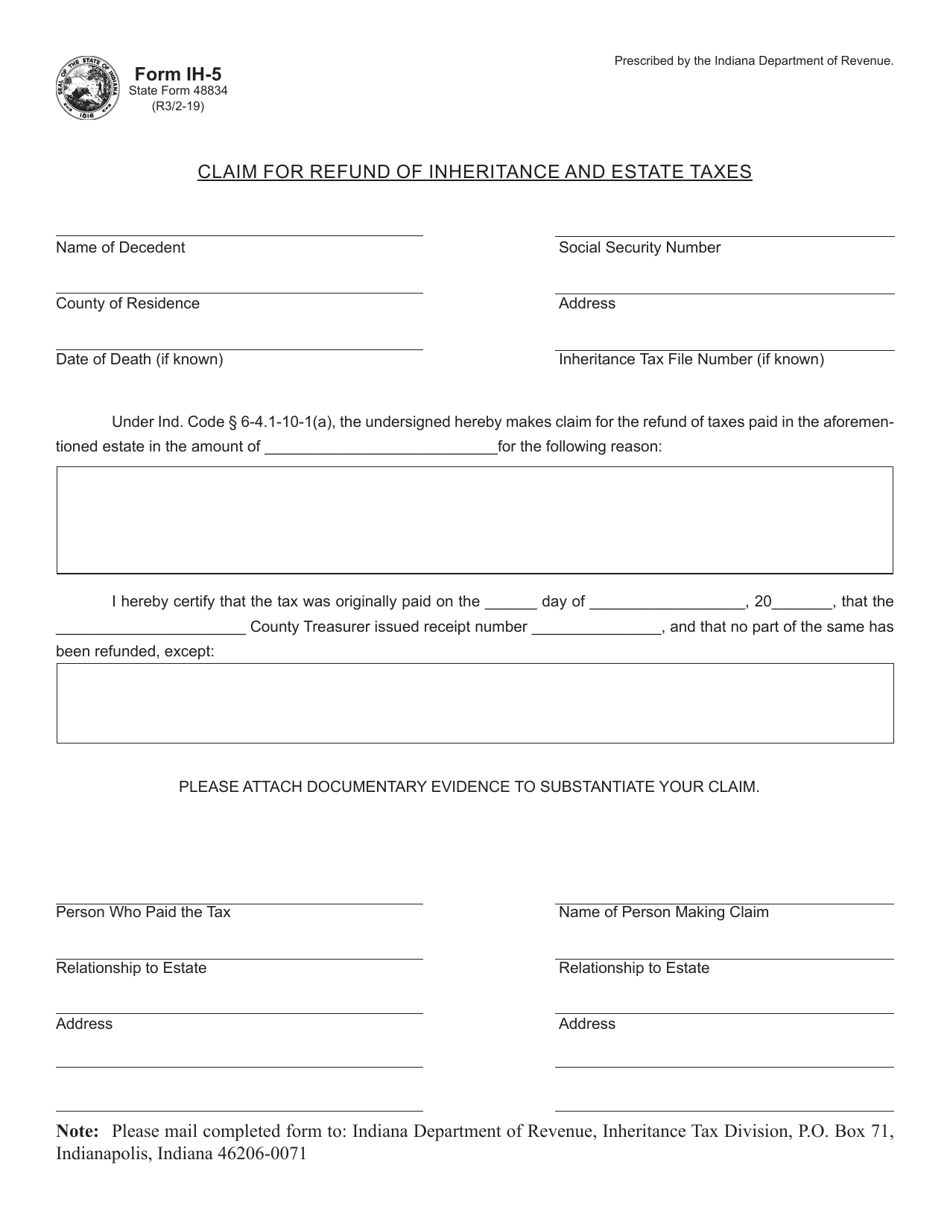

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

Andrea Friends St Petersburg Must Stop Antique Mall Outdoor Decor Antiques

Basics Of Estate Planning Trusts And Subtrusts American Academy Of Estate Planning Attorneys Estate Planning Estate Planning Attorney Revocable Living Trust

Indiana Inheritance Laws What You Should Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

1031 Exchange Real Estate Ultimate Guide Real Estate Real Estate Investing Success Stories

Infographic It S Your Money A Practical Guide The Home Sellers Home Buying Process Home Selling Tips Home Buying Tips

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Lighting Archives The Estate Of Things Craftsman Style Exterior Craftsman Exterior Craftsman House

Filing Taxes For Deceased With No Estate H R Block

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

Salary Agreement Letter Fresh 6 Salary Increase Letter Template Uk Salary Requirements Lettering Salary

Why To Invest In Elss Investing Money Sense Mutuals Funds

States With No Estate Tax Or Inheritance Tax Plan Where You Die